“Ever bought a shiny new gadget, only for it to fizzle out within days? Yeah, us too. But did you know your credit card might actually save the day?”

Imagine this: You splurge on a $500 blender that’s supposed to last five years but breaks down in under three months because of a manufacturer defect. Frustrating, right? Before you resign yourself to endless customer service calls or shelling out more cash, there’s a little-known hero: Credit Card Purchase Protection.

In this post, we’ll dive into everything you need to know about filing Manufacturer Defect Claims using your credit card’s purchase protection benefits. Plus, I’ll share a painfully relatable mistake I made (spoiler alert: my toaster was *not* covered). Let’s break it down.

You’ll learn:

- What credit card purchase protection covers (and doesn’t).

- A step-by-step guide to filing manufacturer defect claims.

- Best practices to maximize your chances of success.

- Bonus tips and real-life examples.

Table of Contents

- Key Takeaways

- Section 1: Why Does This Matter?

- Section 2: Step-by-Step Guide to Filing a Claim

- Section 3: Tips & Best Practices

- Section 4: Real-Life Examples

- Section 5: FAQs About Manufacturer Defect Claims

Key Takeaways

- Credit cards often include purchase protection as a perk—but not all items are eligible.

- Documentation is key when filing Manufacturer Defect Claims.

- Some claims can be denied if your item falls outside specific coverage windows.

- Always review your cardholder agreement before making a purchase.

Section 1: Why Does This Matter?

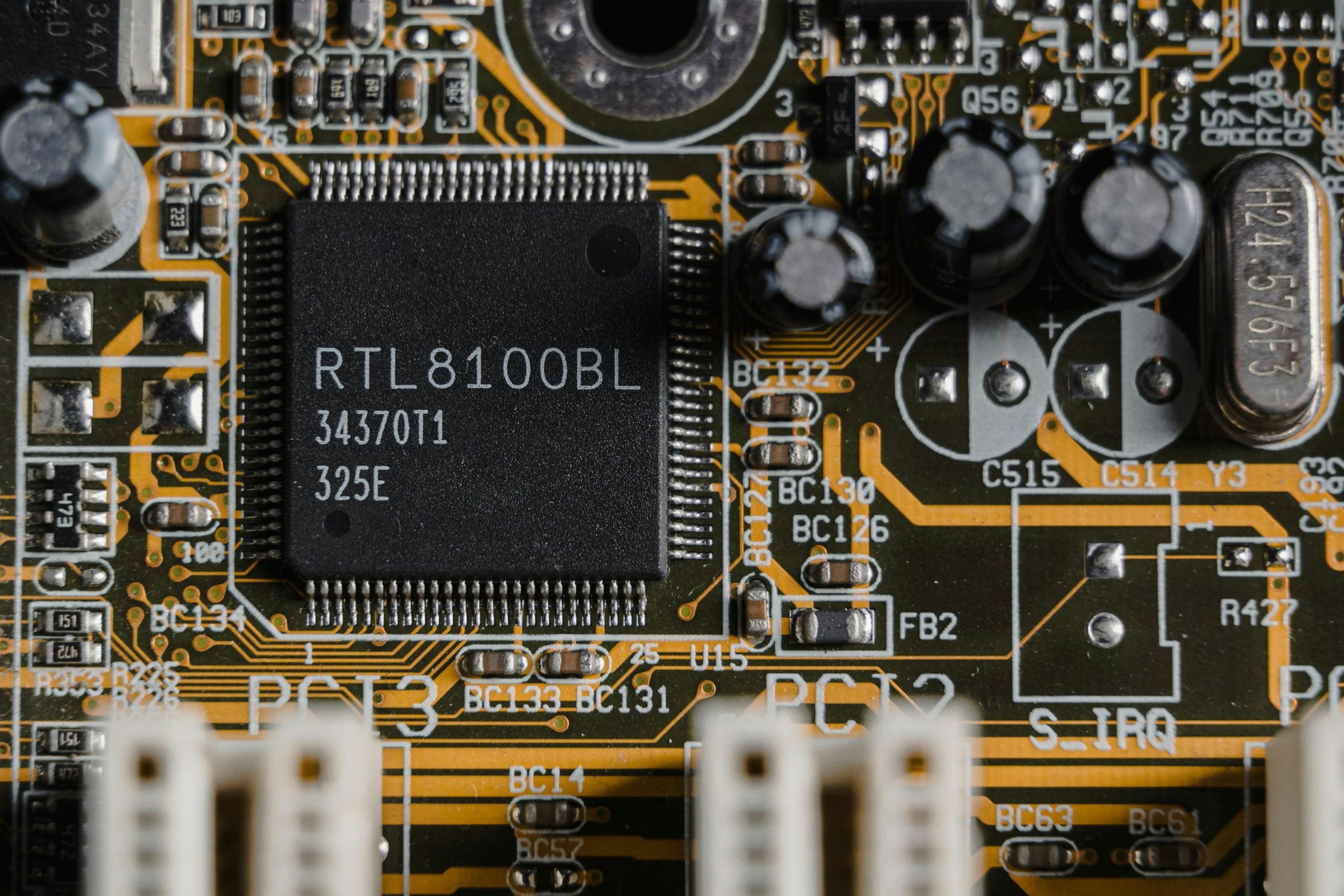

Items like faulty electronics may qualify for manufacturer defect claims through credit card purchase protection.

Think back to a time when something you bought didn’t work as promised. Maybe it caught fire (yikes!) or just stopped working altogether. Now imagine being told by the retailer or brand that they “can’t help” beyond what their limited warranty offers—or worse, refusing any responsibility at all.

This is where credit card purchase protection steps in. Most major credit cards offer some form of safeguard against defective products, unauthorized purchases, or delivery issues. However, understanding how these protections apply to manufacturer defects isn’t always straightforward.

Here’s why it matters:

- Money Saved: Instead of buying replacements, let your credit card foot the bill.

- Time Efficiency: Avoid waiting weeks for manufacturers to resolve issues (if they even do).

- Peace of Mind: Feel confident every time you swipe your card.

Section 2: Step-by-Step Guide to Filing a Claim

Alright, grab your coffee—we’re diving deep now.

Step 1: Check Your Card Benefits

Optimist You: “Surely, my favorite credit card has me covered!”

Grumpy You: “Not so fast—read the fine print first.”

The very first step is checking whether your credit card offers purchase protection and its limits. Typically, this info lives in your cardholder agreement or online benefits portal. Look for keywords like:

- “Purchase protection period” (usually 90–120 days post-purchase)

- “Eligible items” (electronics, clothing, appliances, etc.)

- Exclusions (items purchased secondhand or from unauthorized retailers)

Step 2: Gather Documentation

If you’ve ever tried returning an item without proof of purchase, you already know how critical documentation is. For a manufacturer defect claim, gather:

- Your original receipt

- A clear photo of the defective product

- A written explanation of the issue

- Correspondence with the manufacturer or retailer

Step 3: Contact Your Card Issuer

This could mean calling customer service or submitting an online form. Be prepared to explain the situation calmly and provide all necessary docs.

Step 4: Wait Patiently

No one enjoys sitting around waiting for answers, but most claims are resolved within 2–6 weeks. In the meantime, don’t throw away the defective item—the issuer may ask to inspect it later!

Section 3: Tips & Best Practices

Want to make sure your claim gets approved? Follow these best practices:

- Keep Every Receipt: Even small ones can add up if disputes arise.

- Don’t Wait Too Long: Many cards limit claim submission to 90–120 days after purchase.

- Avoid Unauthorized Retailers: Stick to authorized sellers to ensure coverage.

- Take Photos Immediately: If your blender catches fire, snap pics ASAP—it’s evidence!

Note: One terrible tip floating around suggests ignoring deadlines because “it never hurts to try.” Spoiler alert—it does hurt. Late submissions are almost always rejected.

Section 4: Real-Life Examples

An approved claim feels like winning the lottery—at least until taxes roll around.

Let’s talk wins. A friend once used her Visa card to buy a Dyson vacuum cleaner. Within two months, it overheated and stopped working. After filing a claim with her credit card company and proving the defect was due to manufacturing errors, she received full reimbursement—a win worth celebrating!

But it’s not all rainbows and unicorns. Remember my toaster story? I thought, “Oh, it’s got a lifetime warranty!” Wrong move. Turns out, the store where I bought it wasn’t authorized, leaving me toast-less and broke. Lesson learned: Always double-check authorization status.

Section 5: FAQs About Manufacturer Defect Claims

Q: What qualifies as a manufacturer defect?

A: Any flaw resulting directly from poor design or production processes—not wear-and-tear or user error.

Q: Can I file a claim for older purchases?

A: Unfortunately, no. Most credit cards enforce strict timelines (typically 90–120 days).

Q: Will I get my money refunded or a replacement?

A: It depends. Some issuers refund the amount spent; others send replacements.

Conclusion

Filing Manufacturer Defect Claims via credit card purchase protection isn’t rocket science—but it does require attention to detail. From gathering receipts to knowing your card’s perks, preparation is your best friend here. And hey, if nothing else, remember this: Always keep those receipts organized!

Before we part ways, here’s a haiku:

Defective goods stink,

Credit cards come to the rescue—

Protect thy wallet.